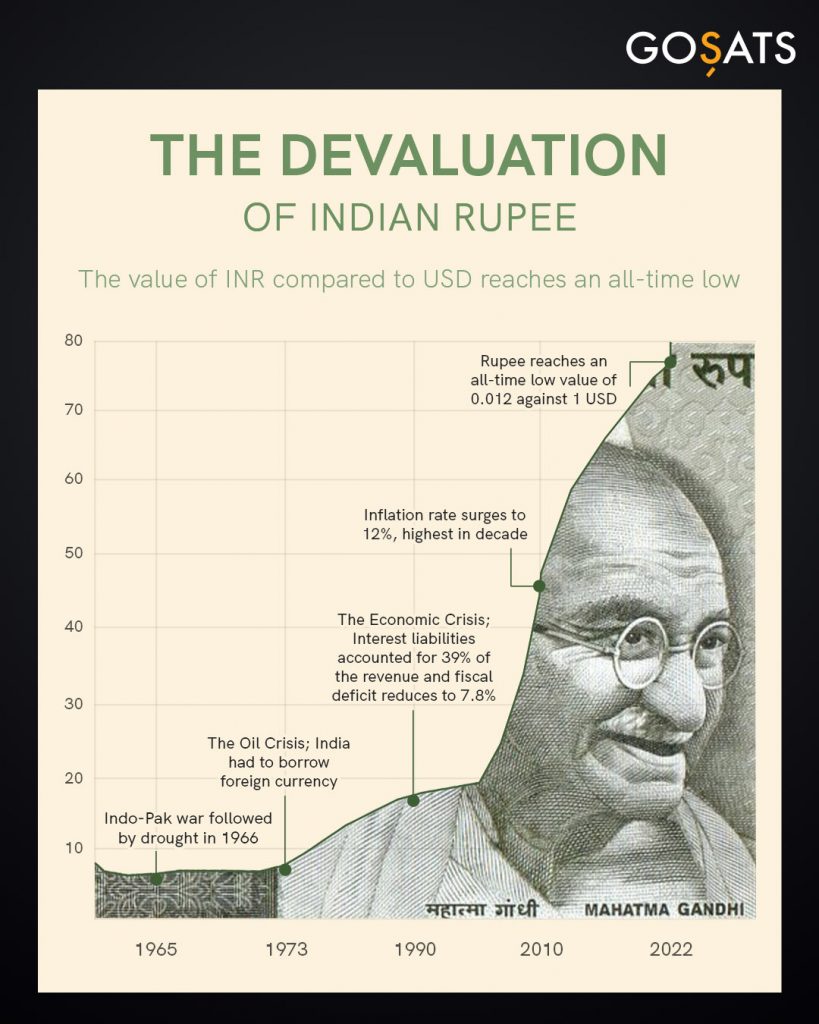

If you’ve been following the news closely, a common headline in recent times has been how the Indian Rupee continues to be on the downward trend, making new lows against the US Dollar. At the time of writing this, 1 USD equals 79.62 INR – and considering global macroeconomic conditions – this figure is only likely to go up.

In fact, since the start of the year, the Indian Rupee has lost over 6 percent against the US Dollar.

Now why has this been happening?

The Rupee has fallen mainly due to three factors: a rise in crude oil prices, a strengthening dollar and persistent foreign capital withdrawals.

Let’s look briefly at each of these factors. India is very much dependent on imported crude oil to meet 80% of its domestic requirements. The Russia-Ukraine war has led to a rise in crude oil prices. When crude oil prices rise, this affects the Indian rupee negatively as crude accounts for a significant portion of India’s imports. In very simple terms, this means that more dollars would be needed to import the oil that India requires.

Simultaneously, the US dollar has strengthened. This is because the US Federal Reserve has been raising interest rates aggressively in an effort to cool the highest inflation the US has seen in a few decades. As the interest rates are increased, this means that investors can get better yields on dollar-denominated securities, thus boosting the dollar’s value.

As the world as a whole deals with inflation and recession on a macroeconomic level, the US is generally considered to be a safer haven than other countries, and especially more so than emerging economies like India. This is another added advantage that the US dollar has.

In fact, this ties to the persistent selling by foreign institutional investors in the Indian market. In fact, FIIs have sold local shares worth nearly $30 billion since the beginning of the year, and bonds worth over $2 billion.

How does this affect the economy and you?

The pressure of inflation and the decline in the Indian rupee does affect the economy negatively. A weakened rupee makes imports costlier, and causes an increase in production costs – thus leading to higher price of goods and services. Since India has a deficit of over $100 billion (imports over exports) in foreign trade and is reliant on crude oil import, this creates a dangerous cycle where the decline in rupee makes the price of petrol and diesel more expensive, which in turn increases the price of everything else as there are costs like transportation for goods.

The most serious implication for the common man is the consistently increasing negative impact this has on savings.

Unfortunately, this trend is expected to continue in the near future, and this means it becomes just as important to manage our investments as inflation looms large, and save in assets that have the potential to be growing in value in time – like Bitcoin.

Let’s stay humble and continue stacking sats!