What is the halving?

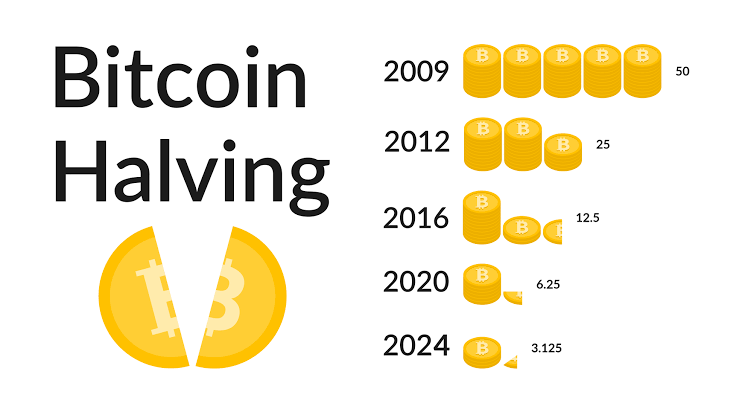

Halving is a process of reducing the rate at which new Bitcoin are generated. Specifically, it refers to the periodical halving events that decrease the block rewards provided to miners.

Bitcoin’s increasing scarcity

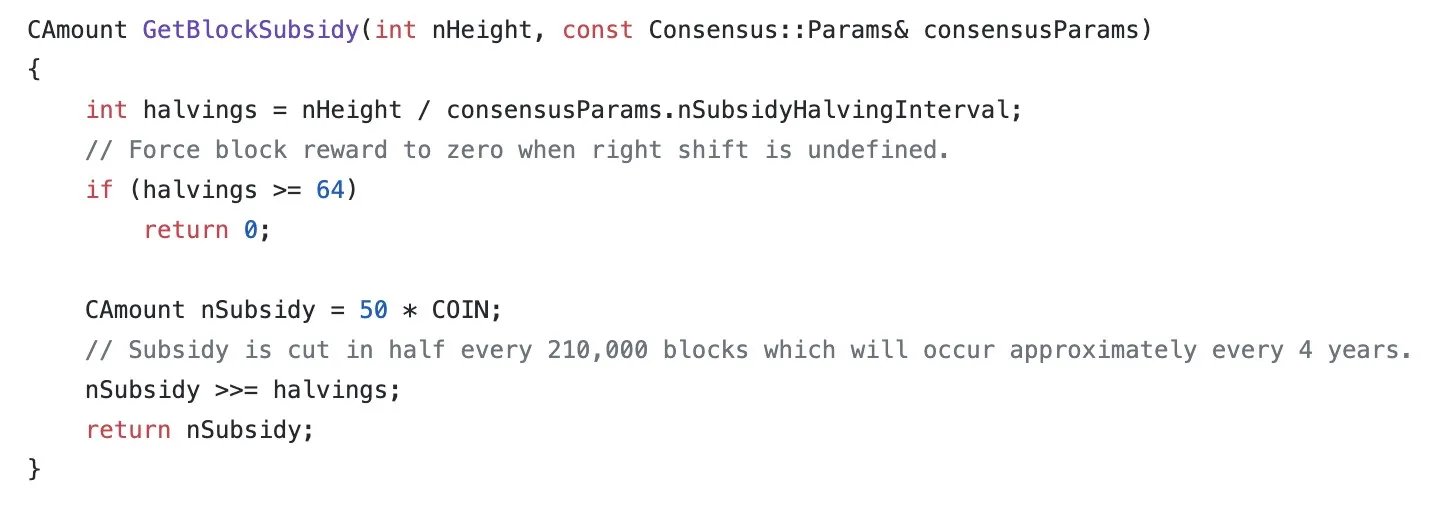

Hardcoded into Bitcoin’s protocol are these few lines of code.

This represents Bitcoin’s entire monetary policy – written in stone from Day 0. These lines are what makes Bitcoin exciting from an investment perspective – it’s “increasing scarcity.”

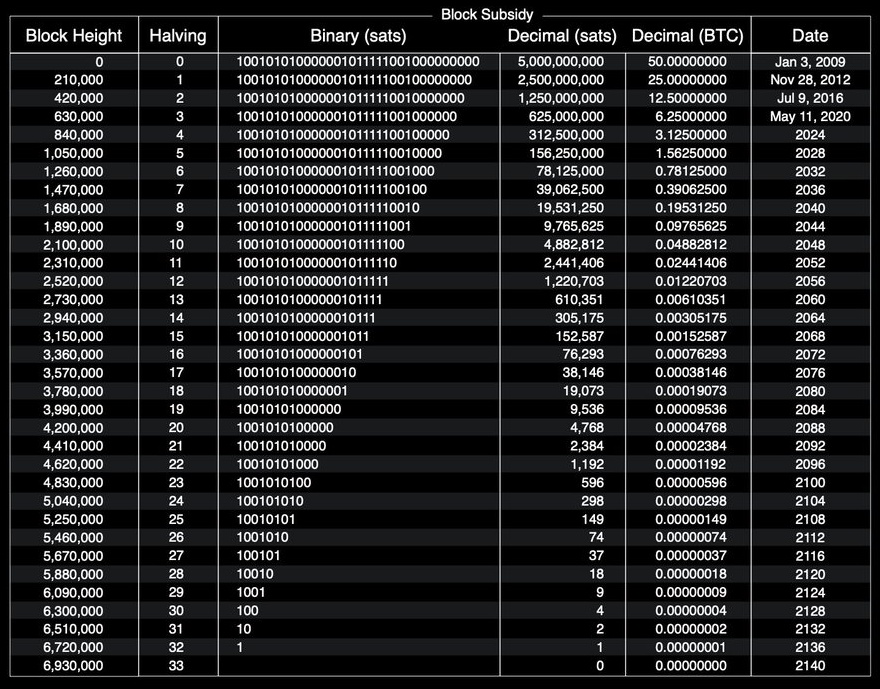

Halvings are at the core of Bitcoin’s economic model as they ensure it will be issued at a steady pace, with a predictable decaying rate. For the first 4 years, 50 new Bitcoin were issued to the miner of each block. Every 4 years, this gets cut to half.

And this pattern of decreasing Bitcoin issuance every 4 years continues until 2140, when no more Bitcoin will be issued ever again.

Supply vs Demand

Right now, ~900 Bitcoin are created every day.

With Bitcoin at ~Rs25 lakh/coin, this means Rs225 crore of Bitcoin is created and issued to Bitcoin miners every day.

Hence, each month, ~Rs7000 crore of new Bitcoin is being created.

For the price to go sideways (as it has been), this means that average demand flowing into Bitcoin must also be ~Rs7000 crore at present

If it was less than this, the price would trend downwards – if it was more, the price would trend upwards.

If we assume that the demand stays constant or goes slightly up, there will suddenly be only Rs3500cr of Bitcoin being created each month, but Rs7000cr of demand.

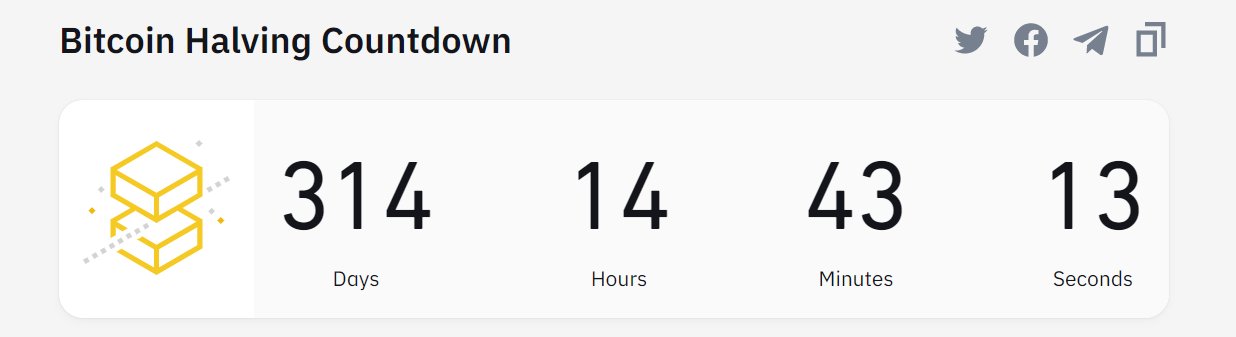

This is a guaranteed, predictable, reliable supply shortage that begins in April 2024.

The only way for the free market to resolve this imbalance of supply and demand is for price to go up.

This supply shortage will accumulate, day after day, and naturally buyers will have to raise their bids in order to find willing sellers.

It’s pure supply & demand!

So, what happens to the Bitcoin price?

Let’s look at past performance first.

Well, Bitcoin has had three halvings in its 14-year lifetime.

And in the 12-18 months that followed each of those events, Bitcoin has seen major bull markets. And, that’s the pattern.

Past performance is not indicative of future results, but this simple pattern is hard to ignore.✅

Infact, it’s very likely that you first heard about Bitcoin during its crazy __________ rally (insert 2013/2017/2021 depending on when you first discovered it)

People who aren’t knowledgeable about Bitcoin will dismiss a pattern like this as chance and think it foolish to expect it to happen again.

However, this thesis is not based on hope, but on basic economics – simple supply and demand!

So, we hope that you understand Bitcoin’s halving and it’s impact on the price.

Most people around you have no idea what will happen when the next halving arrives in a little less than a year.

But you do.

What will you do with that information?